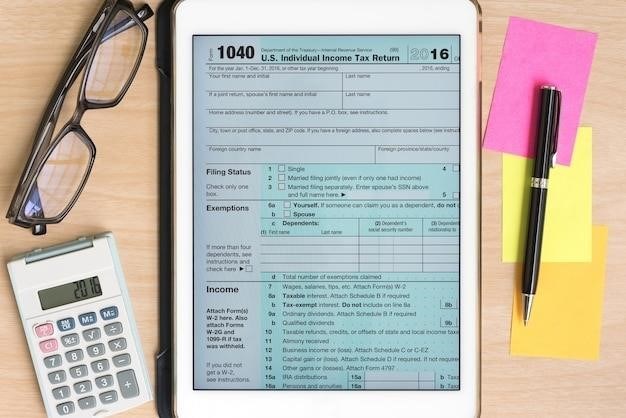

These instructions guide you through completing Form 100S, the California S Corporation Franchise or Income Tax Return. This form is used by S corporations to report their income, deductions, and credits for California tax purposes. The instructions provide detailed explanations of each line on the form, as well as specific instructions for completing various sections. They also cover important topics such as depreciation and amortization, minimum franchise tax, and filing requirements. By carefully following these instructions, you can ensure that your Form 100S is completed accurately and timely.

Overview of Form 100S

Form 100S, the California S Corporation Franchise or Income Tax Return, serves as a crucial document for federal S corporations operating within California. Its purpose is to report the income, deductions, credits, and other relevant financial information of these corporations for California tax purposes. This form plays a vital role in determining the tax liability of S corporations in the state, ensuring that they comply with California’s tax regulations. Essentially, it provides a comprehensive overview of the corporation’s financial activities and its tax obligations to the state. The form is designed to be user-friendly, with clear instructions and guidelines for completing each section. By accurately and thoroughly filling out Form 100S, S corporations can ensure they meet their tax obligations and avoid any potential penalties. It’s crucial to consult the accompanying instructions to properly understand the intricacies of the form and ensure a smooth filing process.

Who Needs to File Form 100S?

Form 100S is a mandatory filing for all federal S corporations that are subject to California’s tax laws. This means that any corporation that has elected to be treated as an S corporation under federal tax law and conducts business in California must file Form 100S. This obligation extends to S corporations regardless of their industry, size, or revenue. The requirement to file Form 100S ensures that these corporations contribute their fair share of taxes to support California’s public services. The form is designed to capture the financial activities of these corporations, including their income, deductions, and credits, allowing the California Franchise Tax Board (FTB) to accurately assess their tax liability. It’s essential for S corporations operating in California to understand their filing obligations and comply with the requirements of Form 100S. Failure to do so can result in penalties and other legal consequences.

Minimum Franchise Tax

The California Minimum Franchise Tax is a crucial element for S corporations operating in the state. It is a fixed amount that all corporations subject to the franchise tax, including S corporations, are required to pay, regardless of their income. This tax is intended to ensure that all corporations contribute to the state’s revenue stream, even those that may not have substantial taxable income. The minimum franchise tax amount is subject to change, but it is generally a fixed sum, typically set at $800. However, there is an exception for newly formed or qualified corporations filing an initial return for taxable years beginning on or after January 1, 2000. These corporations are exempt from the minimum franchise tax for their first taxable year, allowing them to focus on establishing their business without the immediate burden of this tax. The minimum franchise tax is a significant factor in determining the overall tax liability of S corporations in California. It is important for these corporations to understand the requirements and exceptions related to this tax to accurately calculate their tax obligations and ensure compliance with California’s tax laws.

Calculating Tax Liability

Determining the tax liability for California S corporations involves a multifaceted process that considers various factors and calculations. The primary determinant of tax liability is the greater of either the minimum franchise tax or the 1.5% income or franchise tax. This means that S corporations must pay the higher of these two amounts. For financial S corporations, a separate tax rate of 3.5% applies. The calculation process begins with determining the corporation’s state net income, which is calculated by subtracting deductions from gross income. This state net income is then multiplied by the appropriate tax rate, either 1.5% or 3.5%, to arrive at the income or franchise tax liability. However, the final tax liability is the greater of this calculated amount and the minimum franchise tax. It is crucial for S corporations to accurately calculate their state net income, apply the correct tax rate, and compare the resulting income or franchise tax liability to the minimum franchise tax. This comprehensive approach ensures that S corporations fulfill their tax obligations accurately and avoid potential penalties for underpayment.

Schedule K-1 (100S)

Schedule K-1 (100S) serves as a vital component of the California S Corporation Franchise or Income Tax Return (Form 100S). It functions as a detailed report that outlines each shareholder’s share of the S corporation’s income, deductions, credits, and other relevant financial information. This schedule is indispensable for shareholders as they use the information provided to complete their individual California income tax returns. The K-1 (100S) ensures that each shareholder accurately reports their portion of the S corporation’s financial activity, ensuring proper tax compliance for both the corporation and its individual shareholders. It’s crucial for shareholders to retain a copy of their Schedule K-1 (100S) for their records, as it serves as a comprehensive record of their financial involvement in the S corporation for tax purposes. By accurately completing and utilizing Schedule K-1 (100S), both the S corporation and its shareholders can ensure the accurate and transparent reporting of financial information for tax purposes, fostering compliance with California tax regulations.

Depreciation and Amortization

Depreciation and amortization are crucial accounting concepts that play a significant role in determining the tax liability of S corporations in California. Depreciation refers to the gradual decline in value of tangible assets, such as machinery or equipment, over time due to wear and tear or obsolescence. Amortization, on the other hand, applies to intangible assets, such as patents or copyrights, and reflects the gradual reduction in their value as their legal protection diminishes. Both depreciation and amortization are recognized as expenses for tax purposes, reducing the taxable income of the S corporation. These expenses are calculated using specific methods and rules outlined by the IRS, ensuring consistency and fairness in tax reporting. S corporations must carefully track and report depreciation and amortization on their Form 100S, as accurate calculations directly impact their tax liability. Understanding these concepts and their application within the context of California tax law is essential for S corporations to ensure accurate financial reporting and compliance with tax regulations.

Additional Resources

In addition to the instructions provided with Form 100S, several other resources can assist S corporations in understanding and fulfilling their California tax obligations. The California Franchise Tax Board (FTB) website offers a wealth of information, including publications, forms, and online tools. FTB Publication 1001, Supplemental Guidelines to California Adjustments, provides in-depth guidance on various aspects of California tax law, including adjustments relevant to Form 100S. The instructions for California Schedule CA (540) also offer valuable insights into specific tax deductions and credits applicable to S corporations. Furthermore, the FTB website hosts a comprehensive online library of forms and instructions, allowing taxpayers to access the necessary documents for their specific needs. These additional resources serve as valuable tools for S corporations, providing clarity, guidance, and support in navigating the complexities of California tax regulations. By utilizing these resources, S corporations can ensure accurate tax reporting and compliance, fostering a smooth and successful interaction with the California Franchise Tax Board.

Filing Instructions

Form 100S, along with any supporting documentation, must be filed with the California Franchise Tax Board (FTB) by the due date for your tax year. The due date is typically April 15th for calendar-year taxpayers. However, if April 15th falls on a weekend or holiday, the due date is shifted to the next business day. For S corporations with fiscal years, the due date is the 15th day of the fourth month following the end of the fiscal year. Filers can choose to submit their Form 100S through various methods, including mail, fax, and online filing. If filing by mail, ensure that the form is mailed to the address specified by the FTB. For fax filing, use the designated fax number provided on the instructions. Online filing offers a convenient and efficient option, allowing taxpayers to submit their forms electronically through the FTB’s website. Regardless of the chosen method, it’s crucial to ensure timely filing to avoid penalties. Late filing penalties can be assessed for failing to submit Form 100S by the due date, so it’s essential to adhere to the established deadlines. The FTB provides comprehensive information on filing requirements, including deadlines, payment options, and penalty details, on its website and in the accompanying instructions for Form 100S.

Online Resources

The California Franchise Tax Board (FTB) provides a wealth of online resources to assist taxpayers in understanding and completing Form 100S. Their website, ftb.ca.gov, serves as a central hub for information and guidance. Taxpayers can access a comprehensive library of publications, forms, and instructions, including those specifically related to Form 100S. The website also features a search function, allowing users to easily locate specific information by entering relevant keywords or phrases. Additionally, the FTB offers online filing options, enabling taxpayers to submit their Form 100S electronically through their website. This online filing system provides a secure and convenient way to complete and submit tax returns, eliminating the need for manual paperwork and physical mailing. Furthermore, the FTB’s website includes contact information for their customer service department, allowing taxpayers to reach out for assistance or clarifications regarding Form 100S or other tax-related matters. The FTB actively maintains and updates its online resources to ensure that taxpayers have access to the most current information and guidance. By utilizing these online resources, taxpayers can gain a thorough understanding of the requirements for completing Form 100S and navigate the filing process efficiently.

Contact Information

For assistance with Form 100S or any related tax inquiries, the California Franchise Tax Board (FTB) offers multiple contact methods to cater to diverse needs. Taxpayers can reach out to the FTB’s customer service department via phone at 1-800-431-9025. This phone line provides direct access to knowledgeable representatives who can answer questions, resolve issues, and offer guidance on completing Form 100S. Alternatively, taxpayers can utilize the FTB’s online contact form, available on their website, ftb.ca.gov. This form allows users to submit inquiries and requests electronically, providing a convenient and efficient way to communicate with the FTB. For those seeking more in-depth assistance or needing to discuss complex tax matters, the FTB offers a dedicated Taxpayer Assistance Center located in Sacramento. This center provides personalized support and guidance to taxpayers, offering comprehensive assistance with Form 100S and other tax-related issues. The FTB also maintains a social media presence, actively engaging with taxpayers on platforms such as Twitter and Facebook. These channels serve as a platform for sharing updates, announcements, and providing additional information on Form 100S and other tax-related topics. By utilizing these various contact methods, taxpayers can readily connect with the FTB and receive the necessary support and guidance to successfully complete Form 100S.